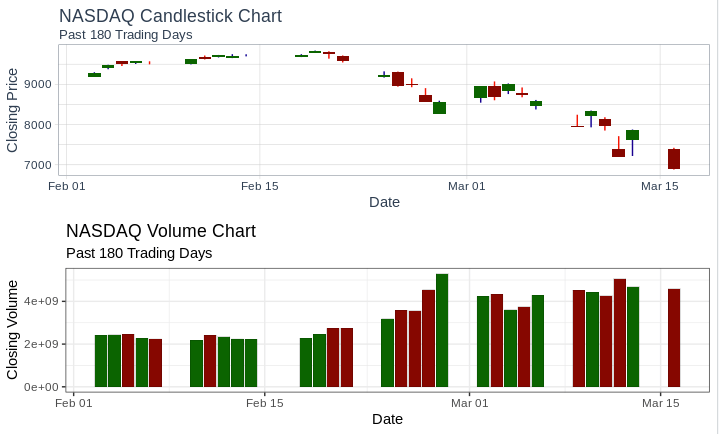

To spot a “bear trap”, or as I call it a “dead cat bounce”, is easy to do once you become tuned to price volume action. A wise man once told me, “volume never lies”. Below are the price and volume charts for the NASDAQ from February 3 to March 16. From February 3 to February 18 the Closing Price (index value) for the NASDAQ increases, but the corresponding volume declines slowly. Starting on the 19th, the NASDAQ experienced a series of down days with increasing volume, with the biggest volume spike occurring on the 27th. The following Monday the price on the NASDAQ sharply increased, but the volume was low! The trap is set (or the cat is dropped). On March 3rd and 4th the NASADQ price remained relatively flat, increasing slightly on the 4th. Then on March 5th the trap is sprung (the cat didn’t bounce because… it’s dead) and the NASDAQ continues to decline with increasing volume. And that is how you spot a dead cat bounce. Look for an increase in price after a period decline with greater and increasing volume. If you see this pattern you should consider selling.

Wow!

Wow!!! What an amazing and strange time we’ve had over the past few weeks. The NASDAQ is close to its pre-coronavirus high; the trend is upward. The DOW and SP500 are experiencing heavy buying. Given the current political state of America, what impact will we see from the riots and continued coronavirus fallout on the economy, thus the markets?

Hard to say. Most of the riots are occurring in blue cities but are alienating voters in red states and cities. From an electoral perspective I call it a wash. So I would expect Trump to win in November and a continuation of the economic policies that the markets like. Yet the election will be won based on turnout, so if Biden can turn out the Democratic base in purple states (which are also being alienated by the riots) he could still win. Though not likely in my opinion.

As for the coronavirus, it appears that the pandemic is subsiding in North America and Europe so we can expect the economies in these areas to return to normal in the next few months. Oil production in the USA is beginning to pick up in anticipation of increased demand. The better than expected employment number reported on 6/5/2020 suggests that we may in fact have a V-ish shaped rebound in the economy.

So all back to normal by Q4 2020? It looks like that will be the case.

Update: The employment numbers reported on 6/5/2020 contained errors making the value lower than expected.

It’s Not V but a ….

In spite of recent market gyrations the markets are continuing to behave normally. Its not clear if we will have a swoosh or a W (or a …) recovery but in my opinion a recovery by years end is on the way.

Under all market conditions you need to know your trading style and how to invest. I recently read an article where a major financial institution sold to wealthy investors an investment instrument that was highly risky. Of course they advertised the instrument as being safe. The instrument lost money and the Feds are currently investigating this institution for fraud. Some basic investment literacy would have warned investors about the type of instrument they were buying. If you are new to investing I would recommend Peter Lynch’s classic “One Up On Wall Street”. It’s how I got started on my investing adventure way back when I was in high school.

The New Normal

The market trading action returned to normal on 4/20. What does normal mean? Well the level of buying and selling is within historical norms. So for one day it seemed like the markets had stabilized. Then the price of oil dropped below zero due to over supply and dwindling storage, causing the SP500 to step back into the heavy selling range. Surprisingly the other indexes did not follow suit, which could lead credence to the theory of the V shaped recovery (~2 weeks left!).

Some in the media think this current up trend is a dead-cat-bounce / bear-trap. It’s not. In a few weeks I’ll explain why it’s not, and how you can spot one. Of course not being a dead cat bounce doesn’t mean our recovery won’t be a W instead of a V. If the oil market continues to fall we could see the collapse of the US oil industry. If that were to happen we would definitely see new lows on all of the indexes.

In light of this you should still trade with caution.

If not a V then a …?

In spite of the drop on 4/7 the rate of selling is coming down, and the rate of buying is returning to normal. Now if the markets were to have a perfect V recovery then we should return to the mid-February valuations around May 9th . Some how I don’t think that will happen. In the upcoming conference calls if information is presented that conforms to or beats the major fund managers’ expectations, and we still have good news on the pandemic front we should see a steady increase in valuation. If the good news continues into the summer we should be up by years end even if there are declines before then.

It is safer now to trade than it has been in previous weeks, but we still could experience extreme volatility. That is why it is important that you understand your risk tolerance and investment time horizon before you execute a trade.

Green Shoots?

The first sign of the end of this most unusual of Bear Markets began on 3/17 when the first attempt to rally the market began. However, downward pressure continues, powered by a lack of positive news about the re-opening of the world economy. Though technically the Bear Market is over the “weirdness continues”. Never before has the worlds major economies told and is effectively beginning to pay their citizens to stay home and not work! This can’t continue forever.

Weirdness in the SP500 has ended with a return to volume levels that were normal prior to the pandemic. However, the 50-day moving average line is about to cross the 200-day line, which does not bode well.

I’ve read in the news that many CEOs sold shares in early February, thus avoiding (adding to) the downturn. This begs the question should you? Well what do the rules say:

Rule 1: Don’t trade on emotion (hope, fear, …). So, selling out of a fear of a coming down turn caused by a global pandemic would be a no-no, but selling to raise cash by realizing a gain that can be used to buy stock during a future up turn is a perfectly reasonable thing to do at anytime.

Rule 2: Trade on market technicals and stock fundamentals and technicals. The markets were technically sound till 2/18 and time to get out would have been by 3/3. So following rule 1 to sell prior to 2/18 would have been fine, but there was nothing unusual about market behavior before then.

Rule 3: Understand your tolerance for risk and time horizon. Since I am blessed with a well paying job that allows me to work remotely, pays more than my monthly expenses thus allowing me to have several months of savings, I don’t need to rely on my money from investments or touch my retirement account till I retire latter in the next decade. So I have a 10+ year time horizon. I also have a high tolerance for risk. If this does not describe you you should avoid selling at a loss (panic selling) but look for safer investments.

As for me I’m not phased by the dramatic loses we have seen and am looking for bargains. Those would be stocks in solid companies that are down now (and may go down more!), but have great potential to recover in the next 6 to 18 months.

The Panic of 2020

Prior to the Great Depression drops in the market and sharp economic declines were called Panics, and that is what I think we are seeing. The uncertainty of the degree of economic impact of the virus and government response to the pandemic is causing people to panic, creating market volatility.

According to my indicators the Dow Jones and Industrials Average is oversold, but downward pressure still exists. The same can’t be said for the NASDAQ and SP500, they are not oversold, and downward pressure still exists. No one yet knows where the bottom is and we may not know this till Q2 2020 conference calls begin in April. Are we overreacting? Hard to say. With suspension of travel to affected countries and the closures of many schools and companies we will definitely see a negative impact on the economy. Are we panicking? In my opinion, yes.

So what should I do? Remember investing is mainly about mindset so:

- … DON’T PANIC …

- Understand your tolerance for risk. Risk is the degree to which your principle will be lost. Essentially my 8% sell rule means I’m willing to lose 8% of my principle. If you do not have a high tolerance for risk or a long investment timeframe you should not make any new stock purchases right now.

- Be financially prepared. This includes taking a diversified approach to investing so when stocks are down other assets are not as affected.

- Cash is king and you should always have cash available to buy stocks when the right price at the right time occurs.

Rules to Sell By

Regardless of the market conditions it is good to have sell rules. Buy and hold isn’t a good strategy for eventually you will have to sell. I mean you are going to need cash to retire with! So, when to sell? My strategy is 8/10/20. Up to a 25% gain, if the stock drops 8% from the highest values since I established the position I sell. If it drops 10% after it has been up 25% I sell. and if it drops 20% after it has been up 100% or more I sell. Of course just because a stock is down 20% does not mean the company has zero long term prospects. A good example is NVIDA. So you need to constantly watch the markets, including old positions, for new entry points.

Another rule I have is to avoid panic selling or selling into a panic, much like what we in my opinion we are seeing now. Of course this may mean incurring heavy short term losses. However, if you have a long term perspective this is manageable. Also having a portfolio across multiple asset classes further mitigates the risk. For example I have half of my retirement account is in real-estate that does not include my primary residence. Consequently, as a whole my retirement account is still up a respectable amount for the year even though the markets are down significantly for the year.

Don’t forget cash is king and there is no shame in ever selling and going to cash. Remember this is a mindset game so heavy losses in the markets just means there are many good bargains out there for people with cash.

It’s Normal… Until…

The amount of buying I’m seeing is normal. The amount of selling I’m seeing is normal. Fortunately for us normal for the markets is for them to go up! However, all may not be well (no pun intended) as we still do not have a clear picture of how the COVID-19 is impacting global economic activity. And we may not know till Q2 earnings season. One company to look at is Apple. Many of Apples’ products are assembled in China by Foxconn, and Foxconn has shut down many of its factories due to CV quarantine. This doesn’t look good, but we won’t know what the true impact is till Q2.

Great Start To A New Year

In spite of the recent downturn the NASDAQ Composite is up ~2.6% since opening on 1/2/20. All of my indicators show low selling but lots of buying, which is a good sign, but a correction, when it happens, could be swift and steep

What does this say about our political economy? The markets are happy with our trade war ceasefile with China and don’t seem to be worried about a potential trade war with the EU. Is a Trump victory a for gone conclusion? That would make the markets happy too.

So what could go wrong? Well, how about a coronavirus pandemic in China hobbling the country’s growth prospect thus undoing the gains granted by the trade war truce. That could do it.

You must be logged in to post a comment.